Regional Foundation Center librarians are frequently asked about accounting services for nonprofit organizations. As librarians, we love to answer your questions, but can’t answer your accounting or tax questions. So we brought in an expert! Joey Pfluger, from tax and accounting firm Bee, Bergvall & Co., answers common questions nonprofits have about types of accounting services and typical costs.

Joey joined Bee, Bergvall & Co. in 2017, initially as a college intern. Upon graduation, Joey became a staff accountant with the firm and currently works in the audit department. He has a BS and an MS in Accounting from Penn State University. Bee, Bergvall & Co. is a suburban firm that was established in 1981, when James Bee left his regional firm to establish his own practice. Bee, Bergvall & Co. operates the Catalyst Center for Nonprofit Management. The Catalyst Center is a management consulting and training firm working with nonprofits to improve their effectiveness through private consultation, as well as through our Nonprofit Management Training Series.

Why does every nonprofit need an accountant?

Partnering with an accountant provides you with a trusted advisor to guide and assist you as you make decisions about your business or organization.

Accounting is a vital part of any successful organization. First and foremost, having an experienced accountant means that good, proper records of financial transactions will be kept, which is something that should not be taken for granted. Having accurate records ensures that the information stemming from them is reliable and can be used for high-level decision-making. In that respect, accountants can often be utilized as key advisors, aiding in the decision-making process. They are able to use their accounting experience to provide financial intelligence to identify trends, as well as areas of strength or weakness, and can share these insights with you.

Working with an accountant can save you both time and money. By sharing their expertise, your accountant can steer you away from costly mistakes, ensure you don’t run afoul of the IRS, as well as assist you in navigating the tax code to ensure you are getting the maximum benefits.

What advice do you have for organizations that need financial assistance?

The best advice is for organizations to stay in front of finances and bookkeeping by educating yourself. Time and funds invested in gaining the knowledge you need as a leader is time and money well spent. If you’re able, take online courses on utilizing software to manage and monitor your finances. The BRIC, community colleges, and community schools often have affordable workshops and seminars, and some even offer scholarships.

If you are a small organization struggling to fund accounting services, one of the best things to do would be to find a board member with an accounting background. By serving as Treasurer, or chairing the finance committee, they can use their expertise to assist the organization.

Okay, Joey, I’m sold! Can you tell me how to go about actually hiring an accountant?

Recommendations and referrals from other executive directors are the first places to start. You can certainly do a quick Google search to give you a general idea of what sorts of accounting professionals are in the area, but before you hire someone, you will want to know their overall level of experience and credentials.

Prior to contacting an accounting professional, try to be as clear as possible with the types of services you are looking for, and ask about the types of experience the professional has in this area. Check out the following article on the "Top 13 Questions to Ask When Hiring a CPA for Your Business".

Also, the Pennsylvania Institute of Certified Public Accountants (PICPA) has a very helpful CPA locator service.

Further, the American Institute of Certified Public Accountants (AICPA) can assist you in locating accountants with specialty designations such as forensics, business valuation, or technology.

The Certified Public Accountant, or CPA designation, is highly held in the accounting profession and is seen as the gold standard. Hiring a CPA will almost always come with a higher price than hiring an accountant without the certification. Note that not all organizations or businesses need the help of a CPA. Often, in small organizations, someone with a background in accounting but without the CPA designation is able to adequately get the job done. Another designation to know is Enrolled Agent, or EA. An EA is a tax practitioner with specialty training on working with the Internal Revenue Service (IRS).

What is the typical cost for accounting services?

The costs for accounting services vary depending on the type of engagement, size, and complexity of the organization, as well as geographic region. Each tax professional may structure their fees differently, and there is not a ‘one-size fits all’ fee.

Before utilizing the services of an accounting or bookkeeping professional, you will want to have a clear Scope of Work and fee for the work to be provided. Again, having your records in good order will save time and money.

Generally, the most expensive type of accounting service for nonprofits is an Audit. An audit is an in-depth accounting service of financial statements, where the auditors will objectively examine and evaluate the financial statements to make sure that the financial records are fair, accurate, and do not materially misrepresent the overall financial transactions of the organization as a whole. Audits offer the highest level of assurance to third parties, and include in-depth examination and confirmation of account balances, inventories, and selected transactions. Audits provide creditors, investors, and other outside parties with a high level of comfort on the accuracy of the financial statements.

Charitable nonprofits that expend $750,000 or more in federal funds in a year are subject to special audit requirements. Also note that some contracts with state and local governments to provide services in the community may require the nonprofit to conduct an independent audit as well.

Next is the Review. Reviews provide limited assurance to outside interests and involve inquiries and analytical procedures that confirm financial statement matters and identify any items requiring further analysis. Reviews are intended to provide lenders and other outside parties with a basic level of assurance on the accuracy of financial statements.

Compilations are usually requested for internal purposes, or in some cases for use by lenders and other outside parties, and are based upon information provided by a company’s management. They do not offer assurance but may involve some adjustment to accounting records.

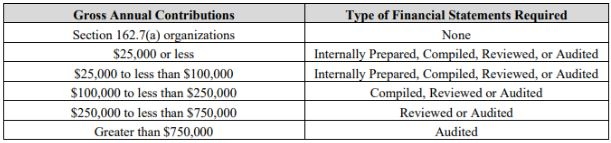

This chart illustrates the thresholds that trigger each type of service for nonprofit organizations.

Financial Statement Requirements for Nonprofits

Again, fees may vary depending on a number of factors; however, these are the typical costs associated with these accounting services:

- Audit – starting cost $6,000

- Review – starting cost $2,500

- Compilation – starting cost $1,000

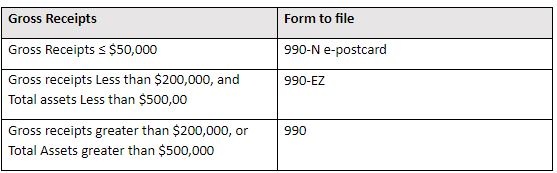

In addition, most charitable nonprofits that are recognized as tax-exempt have an "obligation to file an annual review with the IRS." Form 990 is the required form and is due 5 months after the organization’s year-end.

Form 990 Series Which Forms Do Exempt Organizations File

Fees may vary depending on a number of factors; however, preparation and filing a Form 990-EZ will likely start at $700.

NOTE: All nonprofits with employees must also file the appropriate federal, state, and local employment taxes.

Bookkeeping fees may be on an hourly or project basis and could range from $50-145 an hour.

When is it time to pay for accounting services?

Immediately. Accounting services are part of a successful organization. Budgeting, control of cash flow, and tax planning are essential to long-term success. Accounting professionals are able to step back and look at the big picture allowing the executive director to focus on day-to-day operations. The majority of the time the benefits of hiring an accountant outweigh the cost.

Can you share a horror story about a time a nonprofit organization should have used an accountant but didn’t?

For client confidentiality purposes, no names will be provided. But the story is true.

An organization was operating a nonprofit that was run almost entirely by volunteers, including the accounting work. Note that these volunteers were not CPAs or accountants of any sort. They were searching for new credit opportunities, and one of the prospective lenders required audited financial statements. The vast majority of the nonprofit’s revenues came from earned revenue, not contributions, so they hadn’t been audited in the past.

They hired us for an audit engagement to satisfy the lenders. Our fee estimate was approximately $7,500. When we began, we realized that virtually none of the accounting records were kept properly. There were QuickBooks cash accounts that had balances in their records, but we were told they didn’t really exist. They had close to $750,000 in program revenue but kept virtually no records of receipts, which made it extremely difficult to verify. None of this seemed malicious; everything was just done by volunteers without an understanding of accounting.

The result was that additional time was needed to fix these issues. Had we fully adjusted our billing for all of the additional time and work, the fee would’ve been close to $30,000 instead of the original $7,500. The real possibility of our firm resigning from the project due to these issues was also a risk for the organization which could have cost them the opportunity for the additional funding they sought.

Lesson Learned: All of this could have been prevented with part-time work from a professional bookkeeper. The cost will vary from organization to organization, but rarely will you find that it isn’t worth it. Not only will that professional help your organization run more smoothly and keep proper track of records and financial progress, but it is likely to save costs in the long-term.

FAQ

Help! I still have questions (a.k.a. accounting FAQs)!

Q. What’s the difference between a bookkeeper and an accountant?

A. Although bookkeepers and accountants may do some of the same tasks, a bookkeeper is generally involved in recording transactions and keeping the records organized. An accountant, on the other hand, is trained to analyze, interpret and summarize financial data and have expertise in particular areas such as taxation. Accountants will have a professional 4-year degree as well as a variety of specialty certifications such as a CPA (Certified Public Accountant), an EA (Enrolled Agent), or an MS/MST/MBA (various technical Master’s Degrees).

Q. Why should I use a CPA?

A. As tax advisors, CPAs can provide tax consulting, personal tax planning, business tax advice, other tax services and representation before tax authorities. CPAs can help individuals and families improve their tax position and realize significant tax savings. Certified Public Accountants (CPAs) are required to have either a baccalaureate or master’s degree and also complete at least a total of 24-semester credits in accounting, auditing, business law, finance, etc. and have two years of experience, or complete 150-semester credits including 24-semester credits in accounting, auditing, business law, finance, etc. and one year of experience. In addition, they must pass a comprehensive multi-part exam before they are able to use the CPA designation. So, when you see the CPA designation you can be confident that the individual has extensive education and training.

Further, CPAs are required to complete 80 hours of Continuing Education credits every two years to ensure that they stay current on issues.

Q. Besides preparing my return each year, what other services can my CPA provide?

A. CPAs advise both individuals and organizations on compliance with the tax laws. CPAs are bound by a stringent code of professional ethics and are qualified through their education and experience to provide a wide range of tax services relating to personal and business decisions. They prepare tax returns, provide advice on tax issues, assist plan effective tax strategies for individuals and organizations, and represent taxpayers before taxing authorities.

Q. Is there anything I can do to control the cost of my return?

A. Yes, there are several things you can do. First and foremost, be organized. Keep your records in good order. This will help reduce your total costs. You may utilize financial software or engage the services of a bookkeeper for your business.

Q. Is my information kept private?

A. CPAs, like all providers of personal financial services, are required by law to inform their clients of their policies regarding the privacy of client information. CPAs have been and continue to be bound by professional standards of confidentiality that are even more stringent than those required by law. Cybersecurity is a real threat, and you should ask your tax professional about the safeguards they have in place.

Access bookkeeping and Quickbooks courses via the Free Library’s online learning resources, like Universal Class and Lynda.com!

Have a question for Free Library staff? Please submit it to our Ask a Librarian page and receive a response within two business days.