An exciting new savings opportunity is available to all Americans this tax season--the ability to save a portion of your tax refund into U.S. Series I Savings Bonds.

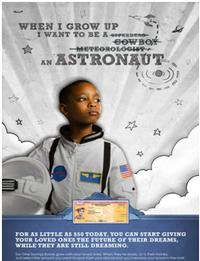

For as little as $50, you can purchase a savings bond with a portion of your tax refund. Tax Time Savings Bonds are a safe and simple way to start giving your loved ones the future of their dreams while they’re still dreaming.

Savings bonds can be purchased in the name of others, so you can gift savings to your loved ones. Just select the amount of your refund you want to save, and you’ll receive your bond in the mail. Tax Time Savings Bonds are fully guaranteed by the United States Government so when you are ready to cash in your bond, you’ll receive all the money you saved plus interest.

Ask your tax preparer this tax season how you can save with bonds. Or, when you are filling out your taxes, use Form 8888 to purchase savings bonds.

Remember to gift a savings bond to your children, grandchildren and loved ones this tax season. For more information visit www.bondsmakeiteasy.org. You can view the Tax Time Savings Bonds campaign video at http://www.youtube.com/user/bondsmakeiteasy.

To learn more about this program, visit the U.S. Department of the Treasury's Frequently Asked Questions page at http://www.treasurydirect.gov/indiv/research/faq/faq_irstaxfeature.htm.

Sarika Abbi is a Savings Initiative Specialist at Doorways to Dreams (D2D) Fund, a non-profit organization working to help all families improve their financial security. D2D Fund, in collaboration with its partners, launched the campaign “Saving is Hard. Bonds Make it Easy” to build awareness of tax time savings bonds and to help encourage all Americans to invest a part of their tax refund in U.S. Savings Bonds.

Have a question for Free Library staff? Please submit it to our Ask a Librarian page and receive a response within two business days.